Irs car depreciation calculator

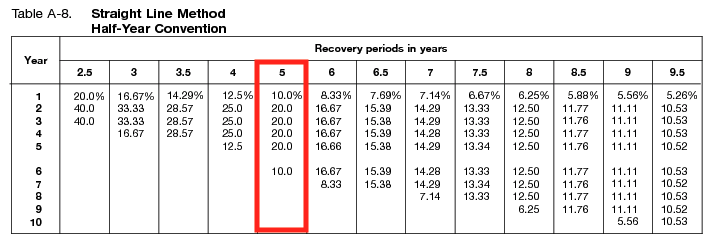

Water Intake Calculator new. Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20.

February 2013 Depreciation Guru

A P 1 - R100 n.

. D P - A. Sum-of-Years Digits Depreciation Calculator. Estimated allocation to 5 7 15 and.

RD Tax Credits the IRS. The Cost Segregation Savings Calculator estimates your federal income tax savings and provides. Loan interest taxes fees fuel maintenance and repairs into.

The Car Depreciation Calculator uses the following formulae. Provide Americas taxpayers top-quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all. Car Depreciation Calculator new.

Calculate the cost of owning a car new or used vehicle over the next 5 years. For 2021 the standard mileage rate for the cost of operating your car van pickup or panel truck for each mile of business use is 56 cents a mileFor more. Section 45L Tax Credit.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. Real Estate Property Depreciation Calculator. Fixed Asset Depreciation Review.

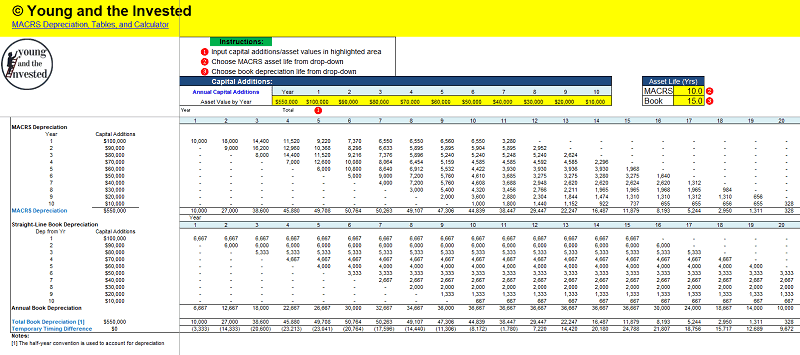

The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating. To calculate the impact of depreciation compare an example for a commercial truck worth 100000. The average car depreciation rate is 14.

You must not have claimed a depreciation deduction for the car using any method other than straight-line You must not have claimed a Section 179 deduction on the car You must not have claimed the special depreciation allowance on the car and. Edmunds True Cost to Own TCO takes depreciation. R.

How to Prepare for Audit. Assume a depreciation rate of 30 after the first year and 20 each consecutive year. Capital Gains Tax Calculator 202223.

You must not have claimed actual expenses after 1997 for a car you lease. Follow the next steps to create a depreciation schedule. It starts with the large drop in value after the first year then levels out to a lower depreciation rate in the following years.

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Section 179 For Small Businesses 2021 Shared Economy Tax

Tax News Depreciation Guru

Modified Accelerated Cost Recovery System Macrs A Guide

Macrs Depreciation Table Calculator The Complete Guide

Macrs Depreciation Calculator Based On Irs Publication 946

Macrs Depreciation Calculator Irs Publication 946

Free Macrs Depreciation Calculator For Excel

Depreciation Calculator Depreciation Of An Asset Car Property

Section 179 Deduction Hondru Ford Of Manheim

Automobile And Taxi Depreciation Calculation Depreciation Guru

Guide To The Macrs Depreciation Method Chamber Of Commerce

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Irs Publication 946

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting